Release Versions: v4.58, v5.0

Statutory Deductions Rollover

Previously, if new tax rates were released in February, but were retroactive to the start of the year (such as the new tax rates released in 2024), you would have needed to create a supplementary payroll to have the balance of statutory deduction (example: $15,000 for employees earning between 100k-200k) reflected, the reduced taxes reflected for each employee, and to refund the difference to employees.

With our new workflow, you can have these balances automatically rolled over and accounted for in your next payroll. The video explains how to accomplish this.

Anonymous Appraisals

Employees can now submit appraisals for colleagues, managers & direct reports anonymously.

3X Payroll Create/Update/Recalculate Performance

Payroll-related actions, especially for payrolls with large numbers of employees, take extensive time to process in TechlifyHR, due to the sheer amount of data being reviewed and aggregated in calculations. Over the past month, we’ve been working on improving the performance of payroll operations, and are happy to say that we’ve achieved an average of 3x improvement in Payroll Creation performance, and up to 5x in some cases. Below are some scenarios we tested in TechlifyHR:

# Employees Previous Create Time New Create Time

100 ~1 minutes 20 seconds ~24 seconds

250 ~3 minutes ~52 seconds

1000 ~12 minutes ~4 minutes

We continue to work on improving payroll performance and hope to continue improving these numbers.

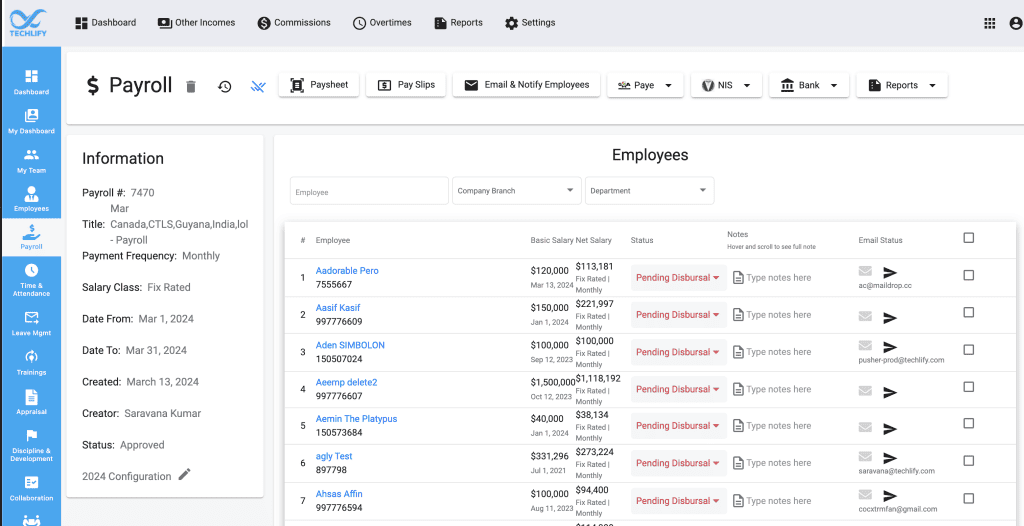

Payroll View Updates

The payroll view page has had significant updates in terms of both layout and performance. Notably:

- The information section is compressed so that more data is shown under the employees’ section

- There is now an inline loading bar, removing the bouncy loading icon, and making the page smoother.

- The overall performance of the page has been improved by approximately 40%

- Approving/Rejecting a payroll no longer results in reloading the entire page, thereby making the functionality smoother.

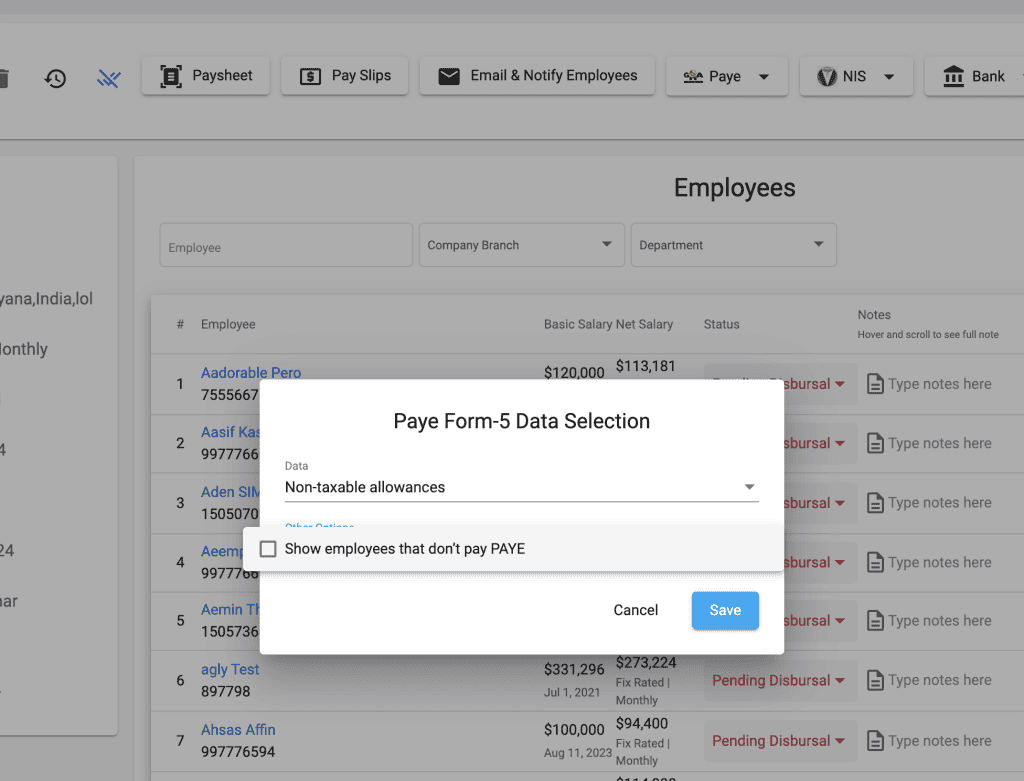

Form-5 Data Selection Options

The PAYE Form 5 E-Submission form on the Payroll page now allows you to select the options you’d like on this form, similar to the Form 2 options.

Form 2A/7B Improvements

We’ve made several improvements to your Form 2 and Form 7 submission process, aiming to simplify the workflow. Firstly, 1000 employees are loaded per scroll, removing the need to scroll for every 25 employees, which can take minutes to load all employees needed on the form.

On Form 7B, we’ve updated the non-taxable allowance section to match GRA’s new form. We’ve now also allowed the option on Form 7B for taxable allowances to be combined with salary.

Contribution Types Management

You are now able to add new types of contributions that your organization may be paying for employees.

Contribution Companies Management

Similar to Contribution Types, you now have the ability to add new companies that you may be using for employee contributions.

Minor Feature & Fixes

- Overtime timezone Issue. Overtimes were being affected by an older timezone issue – this has now been resolved.

- Reliability Improvements. We’ve added more automated testing into TechlifyHR to ensure your experience is consistent as we build new features.

- Sorting Issues. There were some issues with sorting by various table columns in the app – these have now been resolved.