Salary advances are short-term loans given to employees that are deducted later from future salaries. The advance amount is deducted from the net income at the end of the month or over the forthcoming months.

Salary deduction refers to the amount withheld or cut by an employer from an employee’s earnings.

Techlify HRMS allows companies to provide such advances or make necessary deductions using this very convenient feature.

Guide – Advances

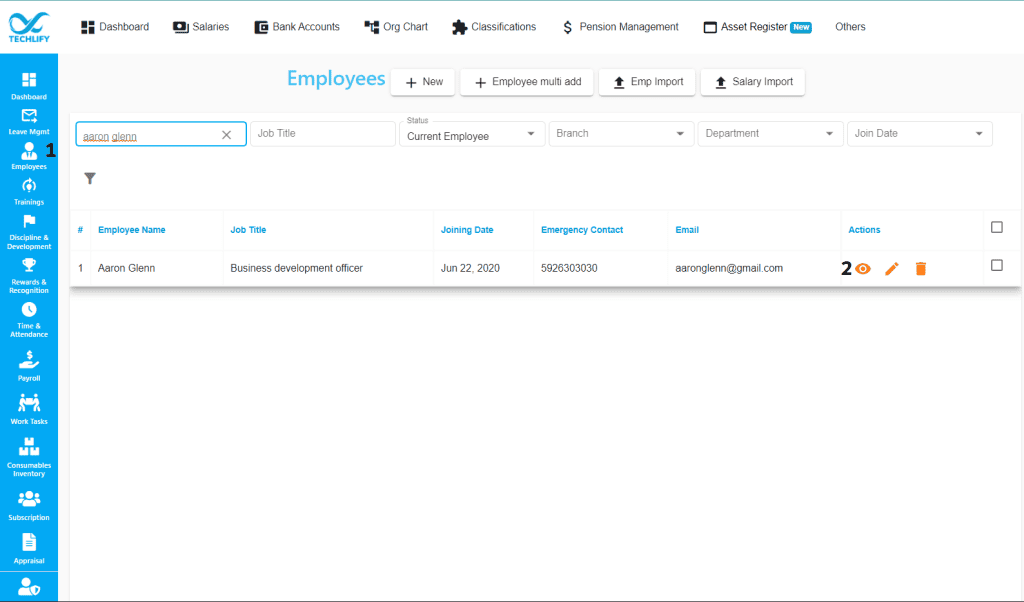

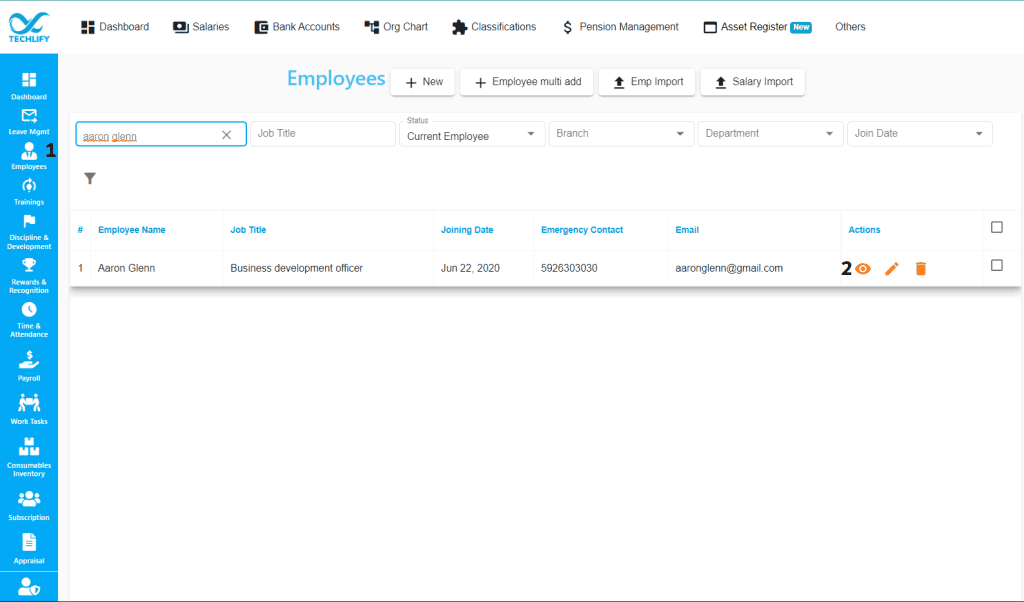

Step 1: Go to Employees Module

Step 2: Find the employee you’d like to add the advance for, and click on the view icon to view their profile.

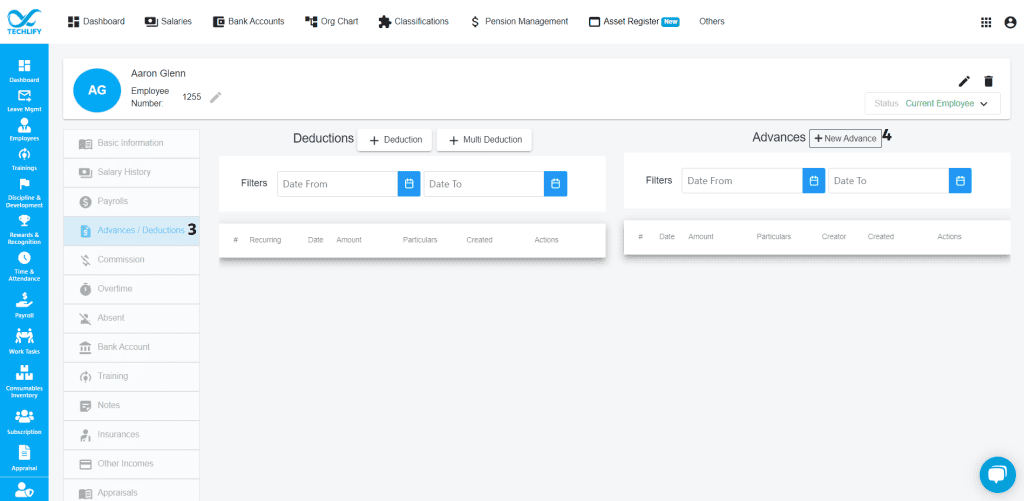

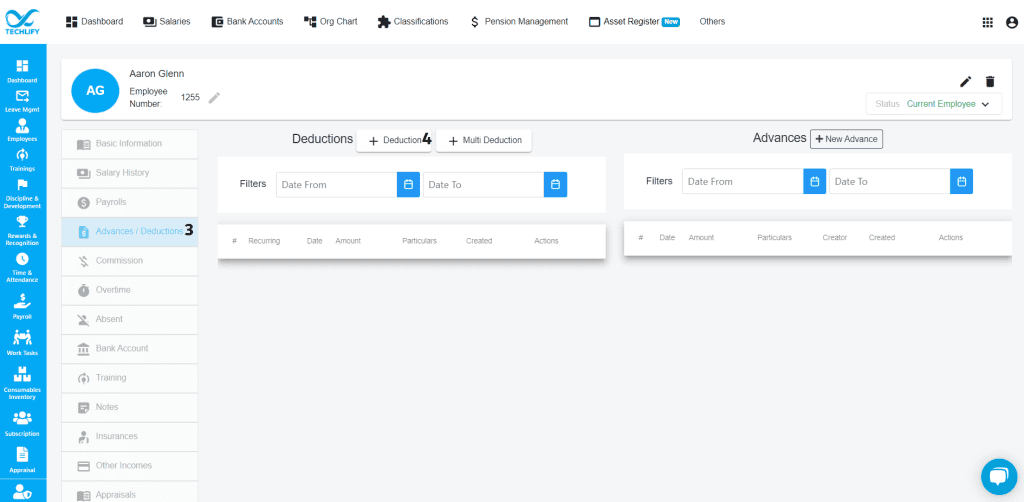

Step 3: Go to the Advances/Deductions tab which can be found on the side menu bar of every employee’s profile.

Step 4: Click on +New Advance to complete advance form.

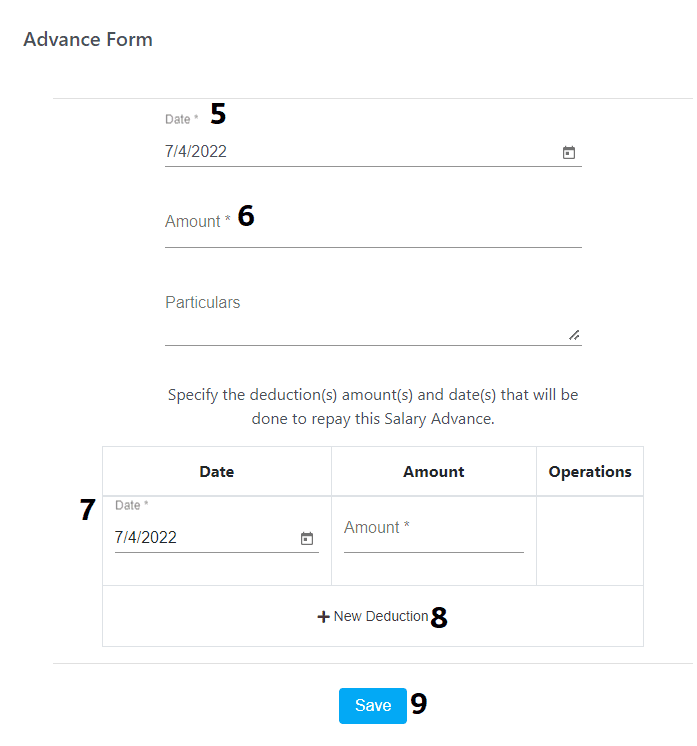

Step 5: Select the date that the advance is being paid on.

Step 6: Enter the amount and/or add any particulars.

Step 7: Specify the deduction amount and date that will be used to repay this salary advance.

Step 8: If the salary advance will be paid in parts, click on +New Deduction to add the other payment dates.

Step 9: Then click on Save.

Guide – Deductions

Step 1: Go to Employees Module

Step 2: Find the employee you’d like to add the deduction for, and click on the view icon to view their profile.

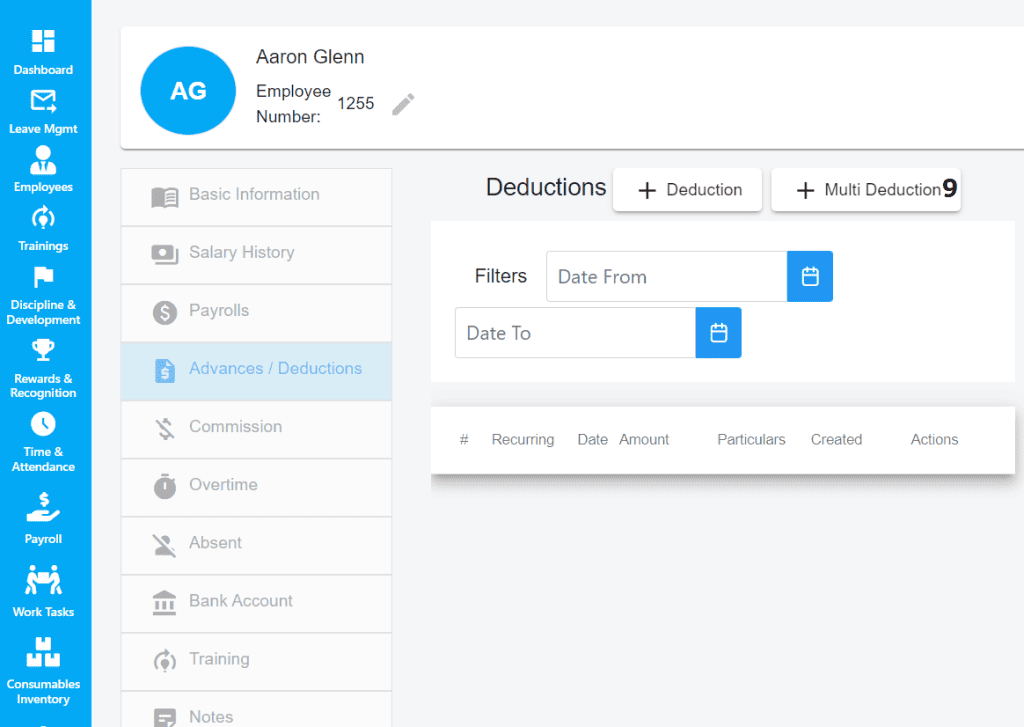

Step 3: Go to the Advances/Deductions tab which can be found on the side menu bar of every employee’s profile.

Step 4: Click on +Deduction to complete deduction form.

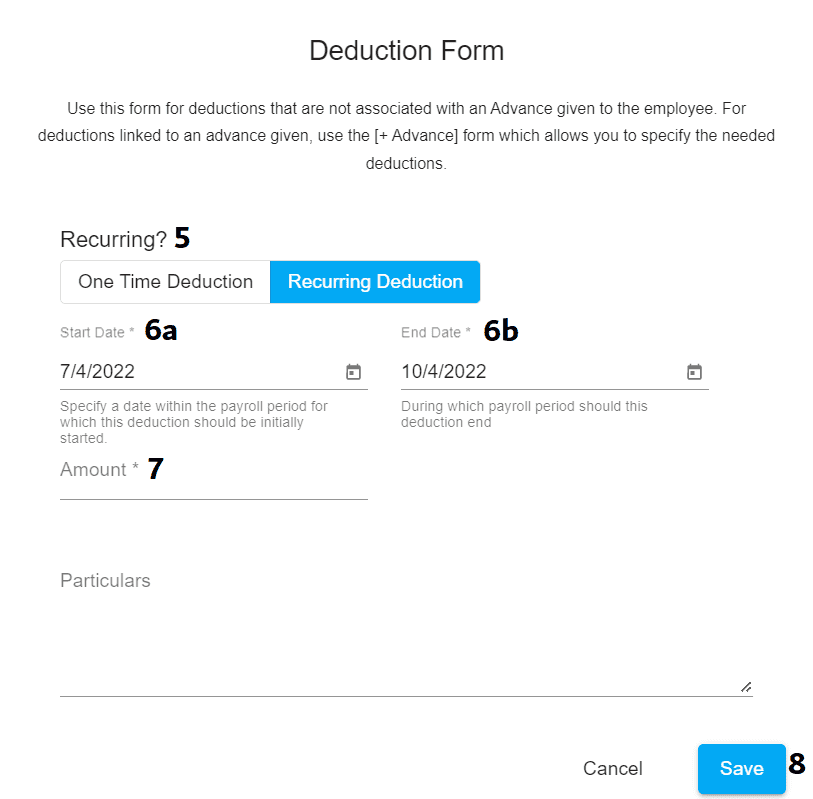

Step 5: Select whether it’s a One Time Deduction or a Recurring Deduction.

Step 6a: If it’s a one time deduction, select the date the deduction will be taken out on. If it’s a recurring deduction, select the start date the deduction will be taken out on.

Step 6b: If it’s a recurring deduction, select end date.

Step 7: Enter the amount and/or add any particulars.

Step 8: Then click on Save.

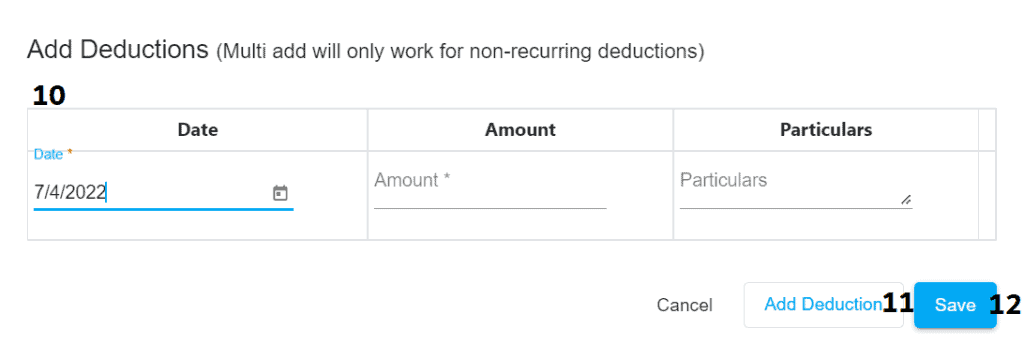

Step 9: Click on +Multi Deduction to add multiple deductions. Multi add will only work for non-recurring deductions.

Step 10: Specify the deduction amount and date that will be taken out on and/or add any particulars.

Step 11: Click on Add Deduction to add more deductions and repeat step 10.

Step 12: Then click on Save.