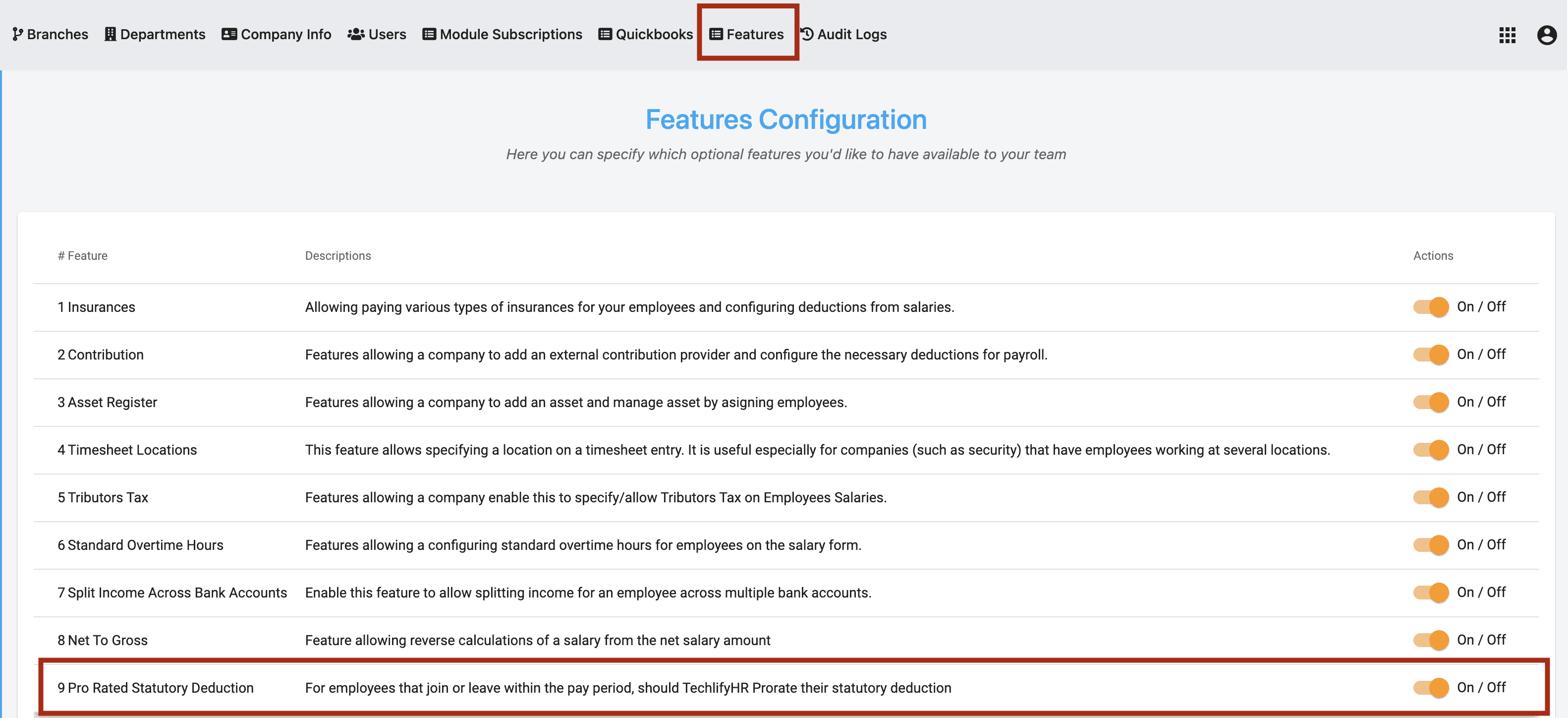

Statutory Deductions are the mandatory payments, deductions, and/or contributions required by law in respect of employees’ salary and other employment benefits. TechlifyHR now introduces a workflow to prorate statutory deductions for employees that either join during the pay period or leave during the pay period. This feature can be enabled from the Administration Module as seen in the image below:

Below are a few scenarios in which an employee’s salary would need to be prorated.

The Problem

Currently, in TechlifyHR, an employee is given their full (85,000 or 1/3) statutory deduction, regardless of whether they worked the full month or part of the month.

However, if an employee with a 150,000 salary worked 1/2 month (August 1-15) at Company A and 1/2 month (August 16-31) at Company B, then with the method above, the employee would receive an 85,000 statutory deduction from both companies, resulting in a total of 170,000 statutory deductions, paying $0 in PAYE for the month of August, which is incorrect.

Scenario 1: Jane Joined in the middle of August

Jane joined on the 12th of August, 2023 on a monthly salary of $130,000. For August, Jane’s gross income would be $84,000

Previously

Jane would’ve had a full statutory deduction of $85,000.

NEW: With Prorated Statutory Deduction

Jane’s prorated statutory deduction is now $51,850

Scenario 2: John Left in the middle of April

John left Company T on August 11th, 2023, he was earning a monthly salary of $100,000. John then joined Company C on the 14th of August, 2023 on a monthly salary of $100,000. His gross income for August would be $106,153 ($41,538 from Company T and $64,615 from Company C).

Previously

John would’ve had a full statutory deduction of $85,000.

NEW: With Prorated Statutory Deduction

John’s prorated statutory deduction is now $33,150 at Company T and $51,850 at Company C which totals up to $85,000 since John worked for the entire month of August.