We’ve been hard at work over the past few weeks on a host of features in our drive to continuously improve our Payroll & HR Software.

Supplementary Payroll

You can now create a Supplementary Payroll, which allows you to have the differences in retro adjustments to taxes or salaries reflected on a new payroll, instead of having to update an existing payroll, especially if the payroll is already approved. Learn all about supplementary payrolls below.

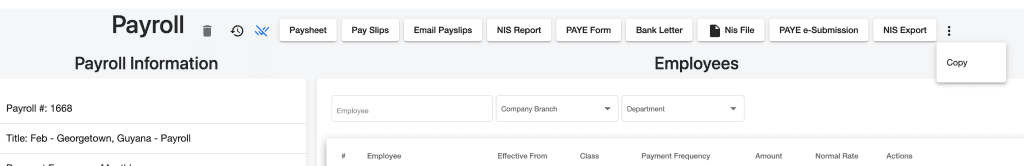

Payroll Copy

A highly requested feature to copy a payroll has now been added. In the payroll copy process, all data of the payroll is copied, with the title changing to “duplicate-of-[payroll-name]”. The option can be found directly on the Payroll view page.

New Tax Rates

The new tax rates have been Gazetted for in the official gazette, we’ve included these new rates in a payroll configuration named “2022 Payroll Configuration”.

Reference: https://officialgazette.gov.gy/images/gazette2022/feb/Extra_11FEBRUARY2022Act5of2022.pdf

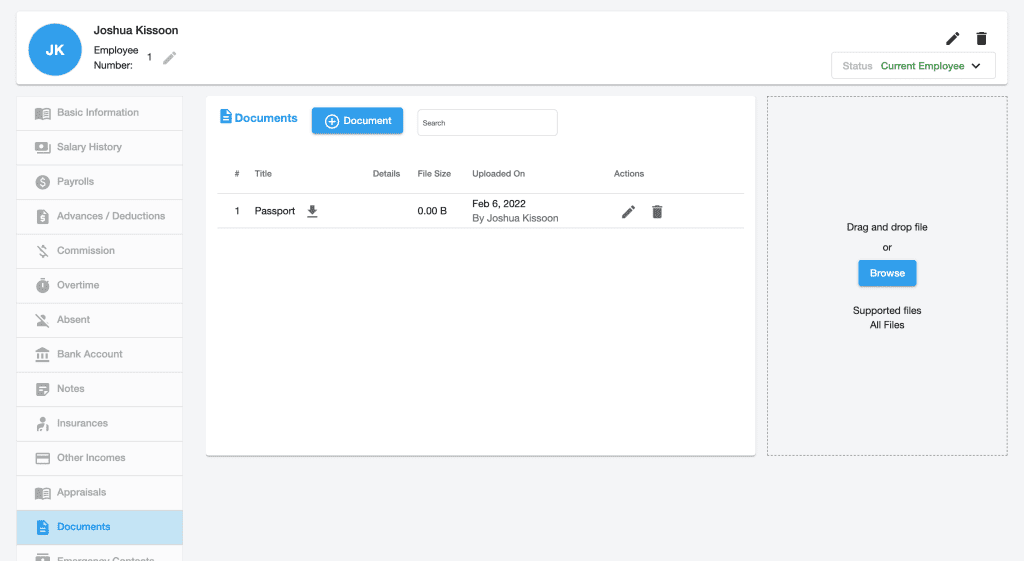

Documents Management

We’ve completely revamped the UI of the Employee Document Management feature and added a few bits of information such as the file size. You can also now upload multiple documents at once via our new drag & drop space.

Certificate Management

Asset Management

Certificate Management

- Form 2A CSV Download – You’re now able to download the Form 2A report in CSV format

- Form 7B bulk Generate – you can now generate Form 7B reports in bulk for multiple employees across entire departments or the entire company at once.

- Urgent Notices – On the main dashboard, there is a section that shows you important areas that needs attention.

- Minor Improvements & Fixes – There are several other improvements to make the app more usable and feature rich.